Introduction

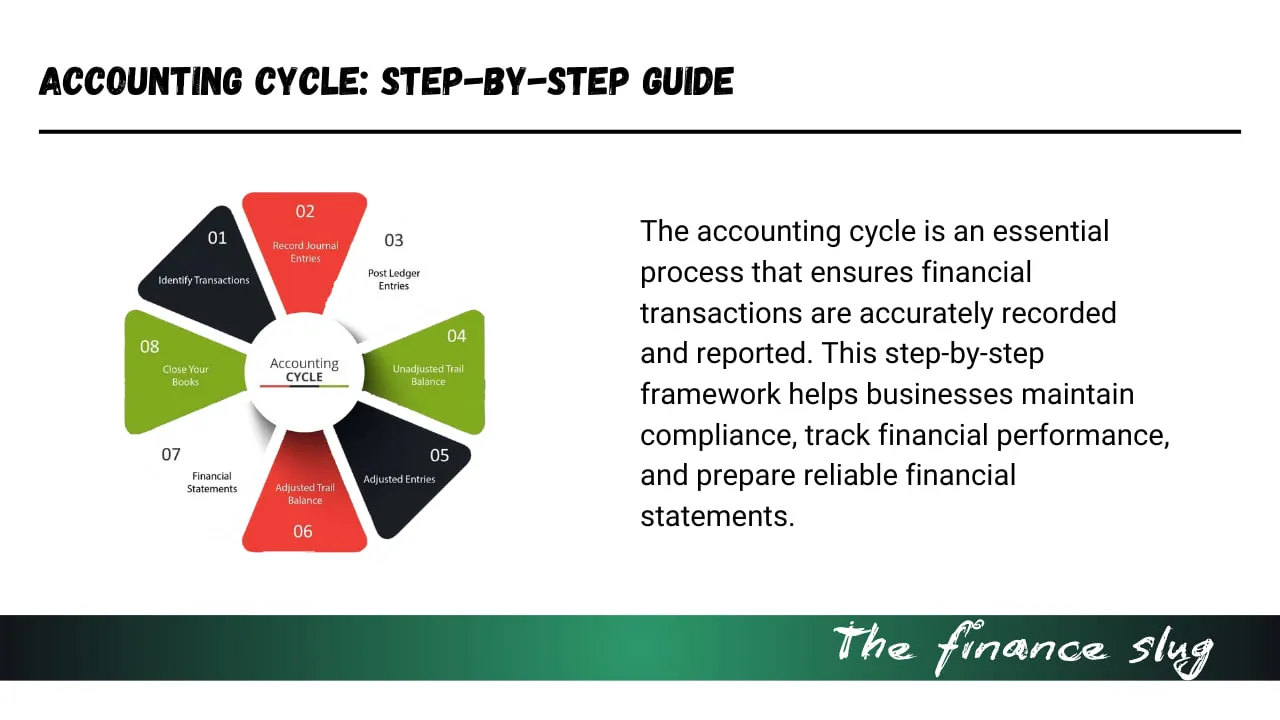

The accounting cycle is a fundamental process in financial management that ensures a company’s financial records are accurate and up to date. It consists of a systematic series of steps used to track, record, and summarize financial transactions.

This cycle is essential for accountants, bookkeepers, and businesses to prepare financial statements and maintain compliance with accounting standards. In this article, we’ll walk you through the 8 essential steps of the accounting cycle, why they matter, and how they help in financial decision-making.

What is the Accounting Cycle?

The accounting cycle is the step-by-step process that businesses follow to track transactions and prepare financial statements. It begins with identifying financial transactions and ends with closing the books to start a new cycle.

This cycle ensures:

✔ Accuracy in financial records

✔ Compliance with accounting standards

✔ Smooth financial reporting for decision-making

The 8 Essential Steps of the Accounting Cycle

Now, let’s break down the 8 key steps of the accounting cycle in detail:

1. Identify Transactions

The first step in the accounting cycle is identifying financial transactions. Only business-related transactions that have a financial impact are recorded.

📌 Examples of Transactions:

- Purchasing inventory

- Paying employee salaries

- Receiving payments from customers

Each transaction must be reliable, verifiable, and documented, often through invoices, receipts, or contracts.

2. Record Transactions in the Journal

Once identified, transactions are recorded in a journal using the double-entry bookkeeping system.

📌 Example of a Journal Entry:

If a company purchases office supplies for $500 on credit:

- Debit Office Supplies Expense: $500

- Credit Accounts Payable: $500

These entries ensure every financial transaction is balanced.

Also Read : Accounting Conservatism: Definition, Principles & Importance in Finance

3. Post to the Ledger

The general ledger is a collection of accounts that records all financial transactions. After journal entries are made, they are posted to the ledger for easy tracking.

Each account (e.g., cash, accounts payable, revenue) has its own ledger, helping businesses summarize financial data efficiently.

4. Prepare an Unadjusted Trial Balance

A trial balance is a list of all accounts with their respective debit and credit balances. It ensures the total debits equal total credits, confirming that transactions were recorded correctly.

📌 Example of a Trial Balance:

| Account Name | Debit ($) | Credit ($) |

|---|---|---|

| Cash | 10,000 | |

| Accounts Payable | 5,000 | |

| Revenue | 8,000 | |

| Salaries Expense | 3,000 |

If the debits do not equal the credits, errors must be investigated.

5. Adjusting Entries

Adjusting entries are made to ensure financial statements comply with accrual accounting principles. These adjustments correct errors or update accounts before finalizing the reports.

📌 Common Adjustments:

✔ Accrued expenses – recording unpaid expenses

✔ Depreciation – accounting for asset value reduction

✔ Prepaid expenses – adjusting for used portions of prepaid items

These adjustments are critical for ensuring accurate financial reporting.

6. Prepare an Adjusted Trial Balance

Once adjustments are made, an adjusted trial balance is prepared. This trial balance includes all corrections and adjustments, ensuring the final financial statements are accurate.

It acts as the final check before preparing the income statement, balance sheet, and cash flow statement.

7. Generate Financial Statements

The primary goal of the accounting cycle is to prepare financial statements that provide insights into a business’s financial health.

📌 Key Financial Statements:

✔ Income Statement – Shows revenue and expenses

✔ Balance Sheet – Summarizes assets, liabilities, and equity

✔ Cash Flow Statement – Tracks cash inflows and outflows

These reports help business owners, investors, and stakeholders make informed decisions.

8. Closing the Books

The final step in the accounting cycle is closing the books for the accounting period (monthly, quarterly, or annually). Temporary accounts, such as revenue and expenses, are closed to the retained earnings account.

📌 Closing Entry Example:

- Debit Revenue Account – $20,000

- Credit Retained Earnings – $20,000

This resets the accounts for the new accounting cycle.

Why is Important?

The accounting cycle provides several key benefits, including:

✔ Ensuring Accuracy: Minimizes errors in financial records

✔ Facilitating Decision-Making: Helps businesses plan for the future

✔ Compliance with Laws: Meets accounting regulations and tax requirements

✔ Financial Transparency: Provides clear insights for investors and stakeholders

Accounting Cycle vs. Budgeting Cycle

The accounting cycle is different from the budgeting cycle, though both are crucial in financial management.

| Feature | Accounting Cycle | Budgeting Cycle |

|---|---|---|

| Purpose | Tracks past transactions | Plans for future finances |

| Timeframe | Monthly, Quarterly, Annually | Annually or as needed |

| Key Output | Financial statements | Budget reports |

While the accounting cycle records financial history, the budgeting cycle helps businesses plan ahead.

Conclusion

The accounting cycle is the backbone of financial management, ensuring that transactions are accurately recorded and reported. Following the 8-step process helps businesses maintain financial integrity, comply with regulations, and make informed decisions.

By understanding and implementing the accounting cycle, businesses can stay organized, reduce financial errors, and achieve long-term success.

Also Read : What is Accounting? Definition, Types, Principles & Importance

Frequently Asked Questions (FAQs)

1. How long does an accounting cycle last?

An accounting cycle typically lasts one accounting period, which can be monthly, quarterly, or annually, depending on the company’s reporting schedule.

2. What is the most important step in the accounting cycle?

Each step is crucial, but generating financial statements is the most important as it provides valuable insights for decision-making.

3. What happens if an accounting cycle step is skipped?

Skipping any step can lead to errors, inaccurate financial statements, and potential compliance issues.

4. Do all businesses follow the same accounting cycle?

Yes, but the complexity may vary. Small businesses may have a simpler cycle, while larger corporations follow strict accounting standards.

5. How can accounting software help with the accounting cycle?

Accounting software automates journal entries, trial balances, and financial statements, reducing errors and saving time.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…