Absorption costing, also known as full costing, is a vital accounting method used by businesses to allocate all manufacturing costs to products. This method ensures that the total cost of production, including both fixed and variable costs, is accounted for when determining product prices and profitability. For businesses looking to refine their financial reporting and pricing strategies, understanding absorption costing is essential. In this guide, we delve into what absorption costing is, its benefits, limitations, and its role in modern business practices.

History of Absorption Costing

Absorption costing has its roots in the early 20th century when industrial production methods began to evolve rapidly. During this period, businesses recognized the need for a systematic approach to allocate production costs accurately to products. This was especially important in manufacturing industries, where fixed costs like factory rent and equipment depreciation were significant.

The method gained widespread adoption as accounting principles became formalized, particularly with the establishment of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). These frameworks emphasized the importance of comprehensive cost allocation for accurate financial reporting. Over the decades, absorption costing has remained a cornerstone of managerial and financial accounting, adapting to modern practices with the advent of advanced accounting software and tools.

In the modern era, absorption costing has become integral to financial management. Businesses in industries ranging from automotive to technology utilize this method to ensure accurate product costing, compliance with regulatory standards, and effective pricing strategies. It also played a significant role during the economic booms of the mid-20th century, enabling companies to navigate high production demands efficiently.

What is Absorption Costing?

Absorption costing is a method where all manufacturing costs—both direct and indirect—are included in the cost of a product. Unlike variable costing, which only considers variable costs, absorption costing incorporates fixed manufacturing overheads into product costs. This approach ensures that the total cost of production is absorbed by the units produced, providing a complete picture of production expenses.

For example, if a company manufactures chairs, the cost under absorption costing would include:

- Direct costs: Materials (wood, screws, varnish) and labor (hours spent by workers).

- Indirect costs: Factory rent, equipment depreciation, and utilities.

This method is widely used in financial reporting, as it aligns with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Components of Absorption Costing

To understand absorption costing thoroughly, it is crucial to break down its components:

- Direct Materials: These are raw materials that become an integral part of the finished product. For example, in furniture manufacturing, wood is a direct material.

- Direct Labor: This includes wages paid to workers who are directly involved in production. For instance, the carpenters crafting furniture pieces.

- Manufacturing Overheads: These are indirect costs that support the production process. Examples include:

- Factory rent

- Equipment maintenance

- Utilities (electricity, water, gas)

- Depreciation of machinery

Absorption costing ensures these costs are evenly distributed across all units produced, creating a comprehensive cost allocation system.

Benefits of Absorption Costing

- Comprehensive Cost Allocation Absorption costing provides a complete picture of production costs by including both fixed and variable expenses. This comprehensive approach aids in accurate pricing and profitability analysis.

- Compliance with Accounting Standards Most accounting frameworks, including GAAP and IFRS, mandate the use of absorption costing for financial reporting. This ensures consistency and comparability of financial statements.

- Simplified Inventory Valuation Absorption costing assigns a portion of fixed overhead costs to inventory, making it easier to value unsold goods. This can have a positive impact on financial metrics like gross profit.

- Better Decision-Making By understanding the full cost of production, businesses can make informed decisions about pricing, production levels, and cost control.

- Support for Long-Term Strategy Absorption costing aligns well with long-term financial planning by offering insights into cost structures that are essential for budgeting and forecasting.

Absorption Costing vs. Variable Costing

While absorption costing is widely used, it is essential to compare it with variable costing to understand its unique features:

| Aspect | Absorption Costing | Variable Costing |

|---|---|---|

| Cost Components | Includes fixed and variable costs | Only includes variable costs |

| Inventory Valuation | Higher due to inclusion of fixed costs | Lower as fixed costs are excluded |

| Profit Reporting | Varies with production volume | Consistent regardless of production |

| Usage | Required for external reporting | Used for internal decision-making |

While variable costing provides a clearer view of how costs fluctuate with production, absorption costing offers a holistic perspective, making it indispensable for financial reporting.

How Absorption Costing Affects Profitability

Absorption costing impacts profitability by influencing how costs are allocated. When production levels are high, fixed costs are spread over more units, reducing the cost per unit and potentially increasing profits. Conversely, when production levels drop, fixed costs per unit rise, which can reduce profitability.

Example:

- A factory incurs $100,000 in fixed overhead costs annually.

- If 10,000 units are produced, the fixed cost per unit is $10.

- If only 5,000 units are produced, the fixed cost per unit doubles to $20.

This dynamic highlights the importance of maintaining optimal production levels to leverage absorption costing effectively.

Absorption Costing in Practice

Businesses across various industries use absorption costing to manage production costs and pricing strategies. Here are some examples:

- Manufacturing: Factories producing goods like electronics, furniture, or vehicles allocate costs using absorption costing to determine accurate product prices.

- Retail: Retailers use absorption costing to value unsold inventory and assess overall profitability.

- Service Industries: While less common, service-based businesses can use a modified version of absorption costing to allocate overheads like office rent and administrative expenses.

Advanced Examples:

- Automotive Industry: Major car manufacturers use absorption costing to allocate costs across complex production processes, ensuring accurate pricing of diverse models.

- Food and Beverage: Producers of packaged goods rely on this method to factor in variable costs like ingredients and fixed costs like plant operations.

Tools and Software: Many companies rely on accounting software like QuickBooks, SAP, or Oracle to implement absorption costing seamlessly, ensuring accurate cost tracking and allocation.

Limitations of Absorption Costing

Despite its advantages, absorption costing has some limitations:

- Overemphasis on Production By allocating fixed costs to products, absorption costing can incentivize overproduction. Excess inventory can tie up capital and increase storage costs.

- Complexity Calculating and allocating manufacturing overheads can be time-consuming and prone to errors, especially for businesses with diverse product lines.

- Less Useful for Decision-Making For internal decision-making, absorption costing may obscure the relationship between costs and production levels, making variable costing more suitable in certain scenarios.

- Potential for Misrepresentation When production levels fluctuate significantly, absorption costing can distort profitability metrics, leading to decisions based on misleading data.

When to Use Absorption Costing

Absorption costing is ideal in situations where:

- Compliance with GAAP or IFRS is required.

- The business seeks a comprehensive understanding of total production costs.

- Inventory valuation is a priority for financial reporting.

However, for internal decisions like cost control or short-term pricing, variable costing may offer better insights.

Future of Absorption Costing

With advancements in technology, absorption costing is evolving. Artificial intelligence and machine learning tools are now being integrated into accounting systems, allowing for more precise allocation of overheads and better forecasting. Cloud-based solutions are also making it easier for businesses of all sizes to implement this method efficiently.

Moreover, as sustainability becomes a focus, companies are exploring ways to incorporate environmental costs into absorption costing models, ensuring a more holistic approach to cost allocation.

Conclusion

Absorption costing is a powerful tool for businesses, offering a thorough approach to cost allocation and financial reporting. By including both fixed and variable costs, it ensures accurate product pricing and compliance with accounting standards. While it has its limitations, understanding when and how to use absorption costing can significantly enhance a company’s financial strategies.

For businesses looking to optimize their costing methods, a blend of absorption and variable costing may provide the best results. By leveraging the strengths of each method, companies can achieve both compliance and operational efficiency.

Share This Guide

Found this guide on absorption costing helpful? Share it with your colleagues, friends, or network and help others understand the importance of accurate cost management. Use the social buttons below to spread the knowledge!

Frequently Asked Questions (FAQs)

What is absorption costing, and how does it differ from variable costing?

Absorption costing is a method that includes all manufacturing costs—both fixed and variable—in the cost of a product. In contrast, variable costing only considers variable costs, excluding fixed overheads. This makes absorption costing ideal for financial reporting while variable costing is more useful for internal decision-making.

Why is absorption costing required under GAAP and IFRS?

Absorption costing ensures that all production costs are allocated to products, providing a complete and accurate picture of financial performance. This aligns with GAAP and IFRS standards, which emphasize comprehensive cost reporting for consistency and comparability.

What are the primary components of absorption costing?

The primary components include direct materials, direct labor, and manufacturing overheads (both fixed and variable). These costs are allocated to products to determine their total production cost.

What are the limitations of absorption costing?

Limitations include its complexity, potential to incentivize overproduction, and less utility for internal decision-making. It can also distort profitability metrics when production levels fluctuate significantly.

Can absorption costing be used in service industries?

Yes, although less common, service industries can adapt absorption costing to allocate overheads like office rent, administrative salaries, and utilities to service offerings. This helps in understanding the full cost of delivering services.

Article Resouces

- IFRS Official Website

- AccountingTools: Absorption Costing Overview

- Investopedia: Absorption Costing

- GAAP Official Resources

- Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian equity benchmark indices BSE Sensex and Nifty50 took a brutal… Read more: Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian equity benchmark indices BSE Sensex and Nifty50 took a brutal… Read more: Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know - Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

Wall Street’s bonus pool hit a record $47.5B in 2024, up 34% from 2023, marking the highest payout since 1987.

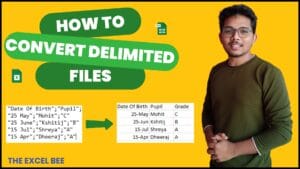

Wall Street’s bonus pool hit a record $47.5B in 2024, up 34% from 2023, marking the highest payout since 1987. - How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel, the data often appears in a single column instead of… Read more: How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel, the data often appears in a single column instead of… Read more: How to Convert Delimited CSV Data into Columns in Excel - Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking initiative to make higher education more accessible. Starting from the… Read more: Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking initiative to make higher education more accessible. Starting from the… Read more: Harvard University Announces Free Tuition for Families Earning $200K or Less - Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge in pharmaceutical investments, thanks to the skyrocketing demand for weight-loss… Read more: Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge in pharmaceutical investments, thanks to the skyrocketing demand for weight-loss… Read more: Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs - Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry, has filed for Chapter 11 bankruptcy for the second time.… Read more: Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry, has filed for Chapter 11 bankruptcy for the second time.… Read more: Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?