- Introduction

- Core Responsibilities of an Accountant

- Legal and Compliance Obligations

- Ethical Responsibilities of Accountants

- Auditing and Assurance

- Risk Management and Internal Controls

- Technology and Modern Accounting

- Types of Accountants and Their Responsibilities

- Educational and Certification Requirements

- Challenges in Accountant Responsibility

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction

Accountants play a crucial role in financial management, ensuring transparency, compliance, and ethical financial reporting. Their responsibilities extend beyond simple bookkeeping—they are vital in decision-making, fraud prevention, and regulatory adherence. Without accountants, businesses and organizations would struggle with financial clarity and accountability.

This article explores the responsibilities of accountants, focusing on their legal, ethical, and operational duties. Understanding accountant responsibility is essential for businesses, aspiring accountants, and financial professionals.

Core Responsibilities of an Accountant

1. Financial Record-Keeping

Accountants are responsible for maintaining accurate financial records. This includes tracking all financial transactions, ensuring proper documentation, and reconciling accounts. Good record-keeping helps businesses make informed decisions and comply with legal requirements.

2. Financial Reporting and Analysis

Accountants prepare financial statements such as income statements, balance sheets, and cash flow statements. These reports provide insights into a company’s financial health and guide executives in strategic decision-making.

3. Budgeting and Forecasting

Budgeting and financial forecasting help businesses plan for the future. Accountants analyze past financial data to predict future trends, ensuring that organizations allocate resources effectively.

Legal and Compliance Obligations

1. Adhering to Tax Laws and Regulations

Accountants ensure that businesses comply with tax laws by accurately calculating and filing tax returns. They help organizations minimize tax liabilities while avoiding legal penalties.

2. Compliance with Financial Reporting Standards

Companies must follow financial reporting standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). Accountants ensure that financial reports meet these guidelines, maintaining transparency for stakeholders.

3. Anti-Fraud Measures

Fraud prevention is a critical responsibility of accountants. They identify irregularities in financial transactions, implement internal controls, and report any suspicious activities.

Ethical Responsibilities of Accountants

1. Integrity and Honesty

Accountants must act with integrity, providing truthful and unbiased financial information. Misrepresentation or manipulation of financial data can lead to legal consequences and damage trust.

2. Confidentiality and Data Protection

Handling sensitive financial information requires confidentiality. Accountants must protect client and company data from unauthorized access and breaches.

3. Professionalism in Accounting Practices

Accountants must adhere to professional ethics, ensuring that their financial assessments and reports are objective and free from conflicts of interest.

Also Read : What is Accountability in Finance? Importance, Benefits & Best Practices

Auditing and Assurance

1. Role of Accountants in Internal and External Audits

Auditors review financial records to verify their accuracy. Internal auditors ensure compliance within the company, while external auditors provide independent assessments.

2. Ensuring Accuracy in Financial Statements

Accountants must ensure that financial statements accurately reflect a company’s financial position. Even minor errors can lead to significant financial discrepancies.

Risk Management and Internal Controls

1. Identifying and Mitigating Financial Risks

Accountants assess financial risks such as market volatility, fraud, and investment challenges. They develop strategies to minimize these risks.

2. Implementing Internal Control Systems

Internal controls help prevent errors, fraud, and inefficiencies. Accountants design and monitor these systems to ensure financial integrity.

Technology and Modern Accounting

1. Role of Software in Accounting Responsibilities

Accounting software like QuickBooks, SAP, and Xero streamline financial tasks. Accountants must adapt to new technologies to enhance efficiency.

2. Cybersecurity Concerns for Accountants

With financial data stored digitally, accountants must ensure cybersecurity measures are in place to protect against data breaches and cyber threats.

Types of Accountants and Their Responsibilities

1. Public Accountants

These professionals provide accounting services to businesses, individuals, and government agencies, including auditing and tax preparation.

2. Management Accountants

Management accountants analyze financial data for internal decision-making, helping businesses improve efficiency and profitability.

3. Government Accountants

Government accountants ensure public funds are used appropriately and that government agencies comply with financial regulations.

4. Forensic Accountants

These accountants investigate financial fraud, providing legal evidence in court cases involving financial crimes.

Also Read : Account Statements Explained: Importance, Types, and How to Read Them

Educational and Certification Requirements

1. Degrees and Qualifications Needed

Most accountants hold a degree in accounting, finance, or a related field. A strong educational background is essential for understanding complex financial principles.

2. CPA and Other Professional Certifications

Becoming a Certified Public Accountant (CPA) or obtaining other certifications like CMA (Certified Management Accountant) enhances credibility and career prospects.

Challenges in Accountant Responsibility

1. Managing Financial Errors and Fraud Cases

Errors in financial reporting can have serious consequences. Accountants must remain vigilant in detecting and correcting inaccuracies.

2. Staying Updated with Changing Regulations

Tax laws and financial regulations frequently change. Accountants must continuously update their knowledge to remain compliant.

Conclusion

Accountants play a fundamental role in financial management, compliance, and risk assessment. Their responsibilities extend beyond number crunching—they uphold ethical standards, prevent fraud, and contribute to business success. By understanding accountant responsibility, businesses and individuals can make informed financial decisions and maintain trust in financial reporting.

Also Read : What is an Accountant? Role, Responsibilities, and Career Guide

Frequently Asked Questions (FAQs)

1. What is the primary responsibility of an accountant?

Accountants manage financial records, ensure compliance, and provide accurate financial reports.

2. Why is ethics important in accounting?

Ethics ensure transparency, trust, and legal compliance in financial transactions.

3. How does an accountant ensure financial accuracy?

By maintaining detailed records, following standards, and conducting audits.

4. What are the risks of non-compliance in accounting?

Legal penalties, financial losses, and reputational damage.

5. What qualifications are needed to become a professional accountant?

A degree in accounting, CPA certification, and continuous professional development.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

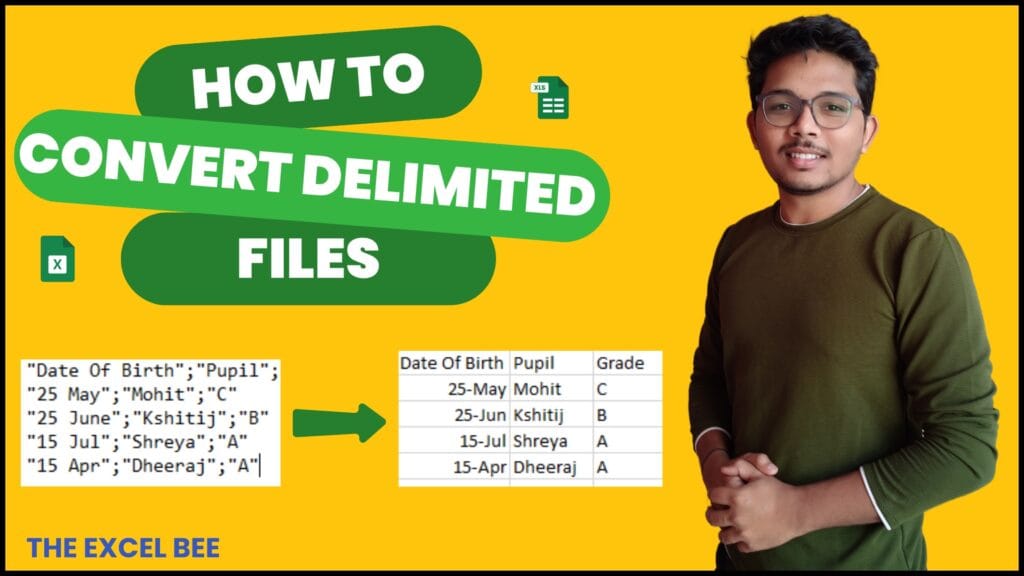

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…