- Introduction to Accounting Conservatism

- What is Accounting Conservatism?

- Key Principles of Accounting Conservatism

- Importance of Accounting Conservatism

- Advantages of Accounting Conservatism

- Disadvantages of Accounting Conservatism

- Accounting Conservatism vs. Other Accounting Principles

- Real-World Application of Accounting Conservatism

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction to Accounting Conservatism

Accounting conservatism is a fundamental financial principle that dictates a cautious approach to financial reporting. It advises accountants to recognize expenses and liabilities as soon as possible but to recognize revenues only when they are assured. This principle ensures that financial statements present a realistic and often understated view of a company’s financial health, preventing the overstatement of profits.

This conservative approach is crucial in financial accounting, as it helps businesses avoid misleading financial statements, ensures compliance with accounting standards such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards), and protects investors from exaggerated financial projections.

In this article, we will explore the concept of accounting conservatism, its importance, advantages, disadvantages, and its impact on financial reporting.

What is Accounting Conservatism?

Definition

Accounting conservatism is an accounting principle that encourages recognizing potential losses and liabilities as soon as they are discovered while deferring the recognition of revenue until it is confirmed. This approach results in a more cautious financial outlook, ensuring companies do not overstate their financial strength.

Basic Principle

The main idea behind accounting conservatism is “anticipate no profit but anticipate all losses.” This means that accountants should only record revenue when it is earned and realizable, while they should record expenses and liabilities immediately when there is a reasonable possibility of their occurrence.

Example of Accounting Conservatism

Suppose a company expects to receive a payment from a client but has doubts about the client’s ability to pay. In this case, conservatism requires the company not to record the revenue until the payment is received. On the other hand, if the company faces a potential lawsuit, the accountant must record a liability as soon as it is probable, even if the exact amount is uncertain.

Key Principles of Accounting Conservatism

1. Recognizing Expenses Early

Businesses must recognize expenses and losses as soon as they are probable, even if they have not yet occurred. This ensures that financial statements reflect potential risks accurately.

2. Delaying Revenue Recognition

Revenue should only be recorded when it is certain and realizable, preventing the overstatement of earnings and avoiding misleading financial statements.

3. Lower Asset Valuation

If an asset’s value is uncertain, it should be recorded at the lower of cost or market value. This prevents businesses from inflating their asset values on financial statements.

4. Estimating Liabilities Cautiously

Companies should estimate potential liabilities conservatively, even when the exact amount is unknown. This ensures that stakeholders are aware of any possible financial obligations.

Also Read : What is Accounting? Definition, Types, Principles & Importance

Importance of Accounting Conservatism

1. Prevents Overstatement of Profits

By recognizing expenses early and delaying revenue recognition, accounting conservatism ensures that profits are not artificially inflated, leading to more accurate financial reporting.

2. Protects Investors and Creditors

Financial statements prepared under a conservative approach provide a realistic view of a company’s financial health. This helps investors and creditors make informed decisions.

3. Ensures Compliance with Accounting Standards

Most accounting frameworks, including GAAP and IFRS, encourage conservatism to prevent financial misrepresentation and maintain transparency in corporate reporting.

4. Reduces Financial Risks

By preparing for potential losses early, companies can manage risks effectively and avoid sudden financial shocks.

Advantages of Accounting Conservatism

- Enhances financial credibility – Investors and stakeholders trust financial statements that follow a conservative approach.

- Reduces risk of legal issues – By not overstating assets or profits, companies avoid potential lawsuits and regulatory penalties.

- Encourages prudent financial management – Managers make more cautious financial decisions when they cannot rely on artificially inflated profits.

- Better risk assessment for creditors – Lenders prefer businesses that follow a conservative approach since it gives a more accurate picture of financial obligations.

Disadvantages of Accounting Conservatism

- Understatement of earnings – Businesses may appear less profitable than they actually are, potentially affecting stock prices and investor confidence.

- Can lead to excessive caution – Too much conservatism may result in companies being overly pessimistic about their financial performance, leading to missed growth opportunities.

- Not always aligned with business strategies – Some companies prefer aggressive growth strategies, which may conflict with conservative accounting practices.

Accounting Conservatism vs. Other Accounting Principles

| Feature | Accounting Conservatism | Aggressive Accounting | Neutral Accounting |

|---|---|---|---|

| Revenue Recognition | Delayed until certain | Recognized early | Standard process |

| Expense Recognition | Recorded early | Delayed | Standard process |

| Risk Approach | Cautious | Optimistic | Balanced |

| Financial Impact | Understated profits | Overstated profits | Accurate profits |

Also Read : Accountant Responsibility: Roles, Duties, and Ethical Standards

Real-World Application of Accounting Conservatism

1. Inventory Valuation

Companies using lower of cost or market value accounting methods apply conservatism by recording lower values when market prices drop.

2. Depreciation and Asset Valuation

Firms often use accelerated depreciation methods, such as the declining balance method, which recognizes higher expenses in the early years, ensuring asset values are not overstated.

3. Contingent Liabilities

If a company is facing a lawsuit, it must recognize a liability even before a final court decision, provided the loss is probable and estimable.

Conclusion

Accounting conservatism plays a crucial role in financial reporting by ensuring companies adopt a cautious approach when recording revenues and expenses. This principle protects investors, creditors, and businesses from financial misstatements and undue risks. While conservatism may sometimes lead to understated profits, its benefits in risk management, regulatory compliance, and financial transparency outweigh its limitations.

Companies should balance conservatism with realistic financial reporting to maintain trust among stakeholders and ensure sustainable business growth.

Also Read : What is an Accountant? Role, Responsibilities, and Career Guide

Frequently Asked Questions (FAQs)

1. Why is accounting conservatism important?

It ensures financial statements provide a realistic view of a company’s financial health, preventing profit overstatement and reducing investor risk.

2. How does accounting conservatism affect financial statements?

It results in lower reported profits and asset values by recognizing expenses early and delaying revenue recognition.

3. Is accounting conservatism required under GAAP and IFRS?

Yes, both GAAP and IFRS encourage conservative accounting practices to ensure financial transparency and accuracy.

4. What is an example of accounting conservatism?

A company facing a lawsuit records a liability before the case is decided, but it does not recognize revenue from a pending deal until the payment is received.

5. Can accounting conservatism be harmful?

Excessive conservatism may understate profits, affecting stock prices and investor confidence, but when applied properly, it enhances financial credibility.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

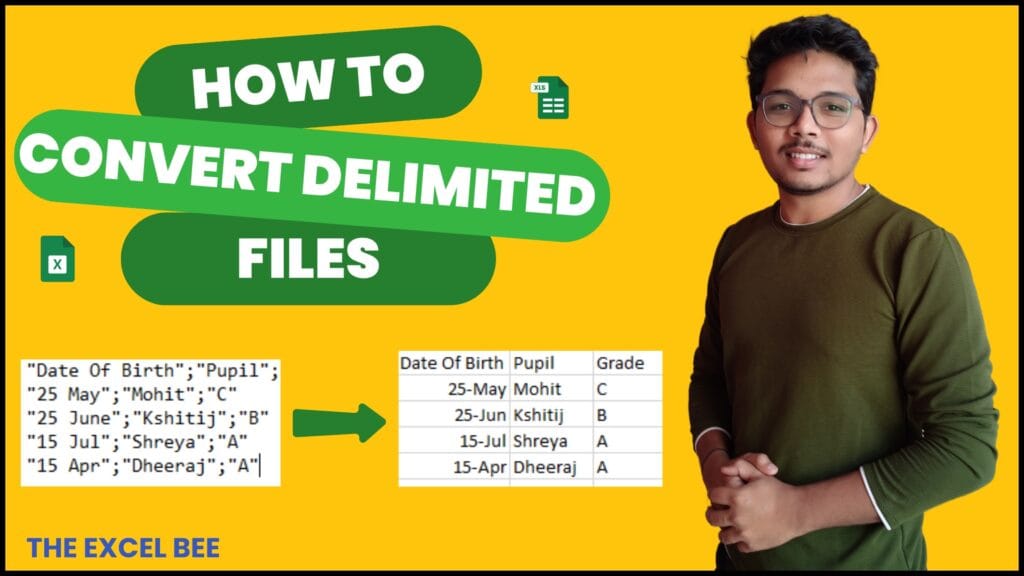

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…