- Introduction

- What is the Accounting Equation?

- Breaking Down the Accounting Equation

- Why is the Accounting Equation Important?

- Practical Examples of the Accounting Equation

- The Relationship Between the Accounting Equation and Financial Statements

- Common Mistakes to Avoid in Applying the Accounting Equation

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction

The Accounting Equation is the fundamental principle that governs financial accounting. It serves as the backbone of a company’s balance sheet, ensuring that all transactions are recorded accurately. Whether you’re a business owner, an accountant, or a student learning about finance, understanding this equation is essential.

In this detailed blog, we’ll explore the formula, its significance, practical examples, and how it ensures the accuracy of financial records.

What is the Accounting Equation?

The Accounting Equation represents the relationship between a company’s assets, liabilities, and owner’s equity. It is expressed as:Assets=Liabilities+Owner’s Equity\text{Assets} = \text{Liabilities} + \text{Owner’s Equity}Assets=Liabilities+Owner’s Equity

This equation ensures that a company’s financial records remain balanced, meaning that every financial transaction affects at least two accounts to maintain this equilibrium.

For example, if a company borrows money (increasing liabilities), it will also receive cash (increasing assets).

Breaking Down the Accounting Equation

To fully grasp the concept, let’s analyze its three main components:

1. Assets

Assets are resources owned by a business that provide future economic benefits. They can be tangible (physical) or intangible (non-physical).

Types of Assets

- Current Assets: Cash, accounts receivable, inventory, and short-term investments

- Non-Current Assets: Land, buildings, equipment, patents, and trademarks

Example of an Asset Transaction

A company purchases equipment worth $5,000 in cash. The balance sheet would reflect:

- Decrease in Cash (Asset): -$5,000

- Increase in Equipment (Asset): +$5,000

Total assets remain the same, keeping the equation balanced.

2. Liabilities

Liabilities represent the debts and obligations a company owes to external parties. These can be short-term or long-term.

Types of Liabilities

- Current Liabilities: Accounts payable, short-term loans, salaries payable

- Non-Current Liabilities: Long-term loans, bonds payable, deferred tax liabilities

Example of a Liability Transaction

If a company takes a $10,000 loan, its balance sheet will reflect:

- Increase in Cash (Asset): +$10,000

- Increase in Loans Payable (Liability): +$10,000

Again, the equation remains balanced.

3. Owner’s Equity

Owner’s Equity represents the owner’s claims on the company’s assets after all liabilities have been paid. It includes:

Components of Owner’s Equity

- Capital Invested by Owners

- Retained Earnings (Profits reinvested into the business)

- Stockholders’ Equity (for corporations)

Example of an Owner’s Equity Transaction

If an owner invests $15,000 into their business, the balance sheet reflects:

- Increase in Cash (Asset): +$15,000

- Increase in Owner’s Equity: +$15,000

This transaction maintains the accounting equation.

Also Read : Accounting Cycle: Step-by-Step Guide for Accurate Financial Reporting

Why is the Accounting Equation Important?

✅ Ensures Accuracy in Financial Reporting

Since every transaction must keep the equation balanced, it helps prevent errors in financial statements.

✅ Forms the Basis of Double-Entry Accounting

Each transaction affects two accounts, ensuring that all records are properly documented.

✅ Provides Financial Insights

Understanding the equation allows businesses to assess their financial position and make informed decisions.

✅ Required for Financial Compliance

Regulatory bodies, investors, and auditors rely on accurate financial records to ensure compliance with accounting standards.

Practical Examples of the Accounting Equation

Example 1: Purchasing Inventory on Credit

A company buys inventory worth $8,000 on credit.

- Increase in Inventory (Asset): +$8,000

- Increase in Accounts Payable (Liability): +$8,000

Equation remains balanced.

Example 2: Paying Off a Loan

A company repays $5,000 of its bank loan.

- Decrease in Cash (Asset): -$5,000

- Decrease in Loan Payable (Liability): -$5,000

Still balanced!

The Relationship Between the Accounting Equation and Financial Statements

1️⃣ Balance Sheet – The equation represents the balance sheet structure, where:

- Assets = Liabilities + Owner’s Equity

2️⃣ Income Statement – Net income contributes to retained earnings, which affects owner’s equity.

3️⃣ Cash Flow Statement – Tracks the movement of cash affecting assets and liabilities.

Common Mistakes to Avoid in Applying the Accounting Equation

🚫 Ignoring Double-Entry Accounting – Every transaction must be recorded in two accounts.

🚫 Incorrectly Classifying Transactions – Misclassifying expenses or revenues can lead to imbalances.

🚫 Not Updating the Equation After Transactions – Failing to adjust financial records can cause discrepancies.

Conclusion

The Accounting Equation is the cornerstone of financial accounting, ensuring that financial statements remain balanced and accurate. Understanding its components—assets, liabilities, and owner’s equity—helps businesses maintain transparency, make informed financial decisions, and comply with regulations.

By mastering the accounting equation, businesses can build a strong financial foundation and achieve long-term success.

Also Read : Accounting Conservatism: Definition, Principles & Importance in Finance

Frequently Asked Questions (FAQs)

1. Why is the accounting equation always balanced?

The equation must always remain balanced because every financial transaction affects at least two accounts, maintaining equilibrium.

2. What happens if the accounting equation is not balanced?

An unbalanced equation indicates errors in recording transactions, which can lead to financial misstatements.

3. How does the accounting equation relate to double-entry accounting?

Double-entry accounting ensures that every transaction is recorded in two accounts, maintaining the balance of the accounting equation.

4. Can the accounting equation change over time?

Yes, as a company conducts transactions, its assets, liabilities, and owner’s equity will fluctuate, but the equation will always remain balanced.

5. How does the accounting equation help in decision-making?

It provides insights into a company’s financial position, helping managers and investors make informed business decisions.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

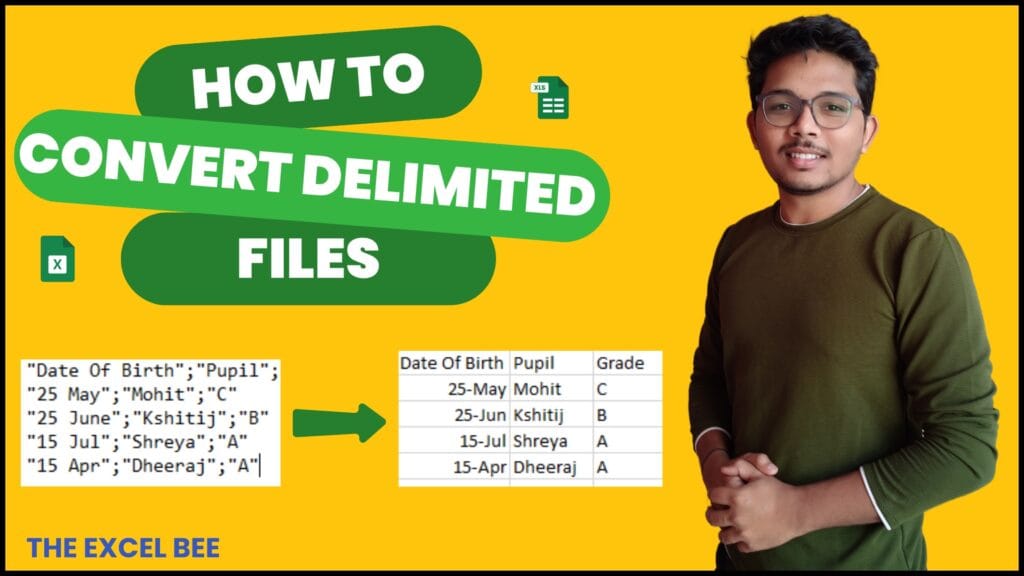

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…