Introduction

Accounting standards play a critical role in financial reporting and ensure consistency, transparency, and accuracy in the presentation of financial statements. Businesses, investors, regulatory bodies, and auditors rely on these standardized principles to assess financial health and make informed decisions.

This blog delves into the definition, objectives, types, and significance of accounting standards in modern financial systems.

What is an Accounting Standard?

An Accounting Standard is a set of guidelines, rules, and principles that dictate how financial statements should be prepared, recorded, and presented. These standards ensure that companies follow a uniform method of accounting, making it easier for stakeholders to compare financial information across different organizations.

Accounting standards are issued by recognized accounting bodies such as:

- International Accounting Standards Board (IASB) – issues International Financial Reporting Standards (IFRS)

- Financial Accounting Standards Board (FASB) – issues Generally Accepted Accounting Principles (GAAP) in the U.S.

- Institute of Chartered Accountants (ICAI) – regulates Indian Accounting Standards (Ind AS)

These standards aim to maintain financial integrity and prevent fraudulent reporting practices.

Objectives of Accounting Standards

Accounting standards are formulated to serve multiple financial objectives. Here are the primary goals:

1. Uniformity in Financial Reporting

Accounting standards ensure consistency in financial statements, making it easier for businesses, investors, and auditors to analyze financial performance.

2. Transparency & Reliability

Financial statements prepared under accounting standards are transparent and reliable, reducing manipulation and misrepresentation of financial data.

3. Facilitating Comparability

By following a common set of accounting principles, businesses can compare their performance with industry peers and competitors effectively.

4. Enhancing Investor Confidence

Investors trust businesses that adhere to global accounting standards, as it reduces financial risks and enhances credibility.

5. Regulatory Compliance & Legal Protection

Accounting standards ensure that financial reports comply with government regulations, preventing tax fraud, financial misconduct, and legal penalties.

Types of Accounting Standards

Accounting standards vary based on regulations and the financial reporting framework adopted by a country. Here are the major types:

1. International Financial Reporting Standards (IFRS)

Issued by IASB, IFRS is a globally accepted accounting framework used in over 140 countries, including the European Union, Canada, and Australia. It ensures financial consistency across international markets.

Key IFRS Principles:

- Fair Value Measurement: Assets and liabilities must be reported at fair market value.

- Revenue Recognition: Revenue should be recorded when earned, not when received.

- Accrual Accounting: Expenses and incomes should be recorded when incurred, not when cash is exchanged.

2. Generally Accepted Accounting Principles (GAAP)

GAAP is used primarily in the United States, issued by FASB. It emphasizes detailed financial disclosures and strict regulatory compliance.

Key GAAP Principles:

- Historical Cost Principle: Assets must be recorded at their original cost.

- Matching Principle: Revenues must be matched with related expenses.

- Full Disclosure Principle: Financial statements must provide all relevant information to stakeholders.

3. Indian Accounting Standards (Ind AS)

India follows Ind AS, which is largely based on IFRS, but modified to suit local business and taxation requirements. The Institute of Chartered Accountants of India (ICAI) governs these standards.

4. Government Accounting Standards

Governments follow separate accounting standards for public financial management, including budgetary allocations, expenditures, and taxation.

Also Read : Accounting Ratio: Definition, Types, Importance & Key Formulas

Importance of Accounting Standards in Financial Reporting

The adoption of accounting standards is crucial for multiple reasons:

1. Prevents Financial Fraud

Standardized accounting rules help in identifying and preventing fraudulent practices such as revenue manipulation, overstating profits, or hiding liabilities.

2. Attracts Global Investments

Businesses that follow internationally recognized standards such as IFRS attract foreign investors, boosting financial growth.

3. Strengthens Corporate Governance

Accounting standards promote ethical financial practices and accountability, ensuring compliance with corporate governance laws.

4. Supports Economic Stability

Transparent financial reporting builds trust in financial markets, reducing economic risks and ensuring sustainable economic growth.

Challenges in Implementing Accounting Standards

Despite their importance, implementing accounting standards faces several challenges:

1. Complexity of Regulations

Companies find it difficult to comply with extensive and frequently changing accounting rules, especially in global business operations.

2. High Implementation Costs

Complying with IFRS or GAAP requires significant investments in accounting software, training, and audit fees.

3. Differences Between IFRS & GAAP

Since IFRS and GAAP have fundamental differences, multinational corporations need to adjust financial statements when operating in different countries.

4. Resistance from Businesses

Many organizations resist adopting new accounting standards due to the cost and effort required for restructuring financial reporting systems.

Conclusion

Accounting standards are the backbone of financial reporting, ensuring accuracy, transparency, and comparability across businesses. Whether it’s IFRS, GAAP, or country-specific regulations, adherence to these standards enhances investor confidence, prevents fraud, and supports economic stability.

Companies that follow standardized accounting practices not only gain credibility but also attract better investment opportunities and legal protection. Therefore, understanding and implementing accounting standards is vital for any business aiming for long-term financial success.

Also Read : Accounting Rate of Return (ARR) – Formula, Calculation & Importance

Frequently Asked Questions (FAQs)

1. What is the difference between IFRS and GAAP?

IFRS is a globally accepted accounting framework, whereas GAAP is specifically used in the United States. IFRS follows a principles-based approach, while GAAP is more rules-based with detailed guidelines.

2. Why are accounting standards important?

Accounting standards ensure financial transparency, comparability, regulatory compliance, and fraud prevention, which boosts investor confidence and strengthens corporate governance.

3. How do accounting standards benefit investors?

Accounting standards provide consistent financial information, making it easier for investors to compare companies and make informed investment decisions.

4. Who sets accounting standards?

The IASB sets IFRS, the FASB sets GAAP (U.S.), and national accounting boards set country-specific standards like Ind AS in India.

5. Are accounting standards mandatory?

Yes, companies must follow the applicable accounting standards in their respective countries to comply with financial regulations, taxation laws, and corporate governance rules.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

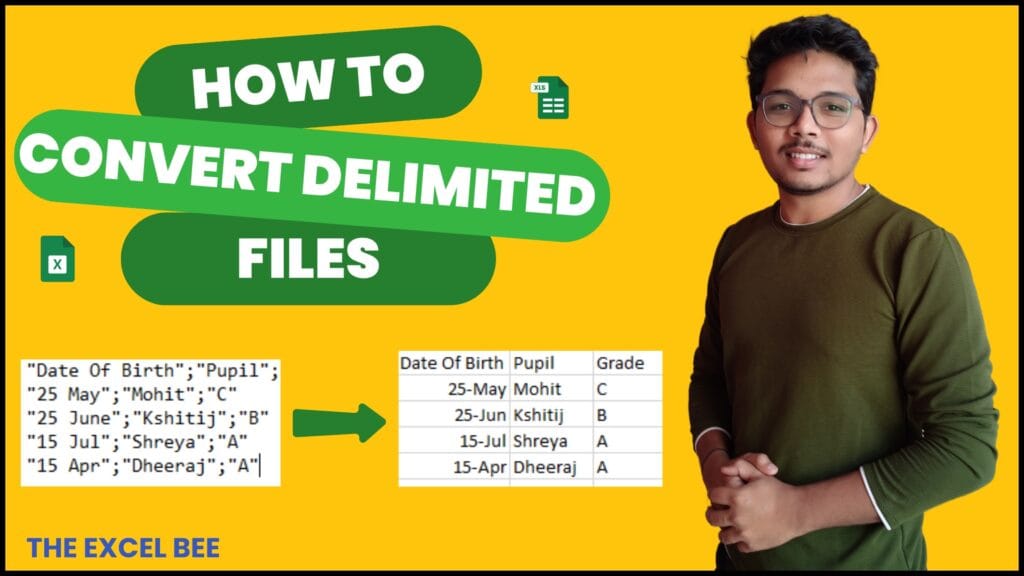

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…