Compound interest is one of the most powerful concepts in personal finance. Whether you’re saving for retirement, investing in stocks, or paying off debt, understanding how compound interest works can help you make smarter financial decisions. In this blog, we’ll break down what compound interest is, how to calculate it, and the many benefits it offers.

What is Compound Interest?

At its core, compound interest refers to the interest you earn on both the principal (the initial amount of money you invested or borrowed) and the interest that has been added to it. This “interest on interest” effect makes compound interest different from simple interest, which only calculates interest on the initial principal amount.

For example, let’s say you invest $1,000 at an interest rate of 5% per year. With simple interest, you would earn $50 each year. However, with compound interest, the interest is added to the principal, and the next year’s interest is calculated on the new, larger amount. Over time, this leads to exponential growth in your investment.

How Compound Interest Works

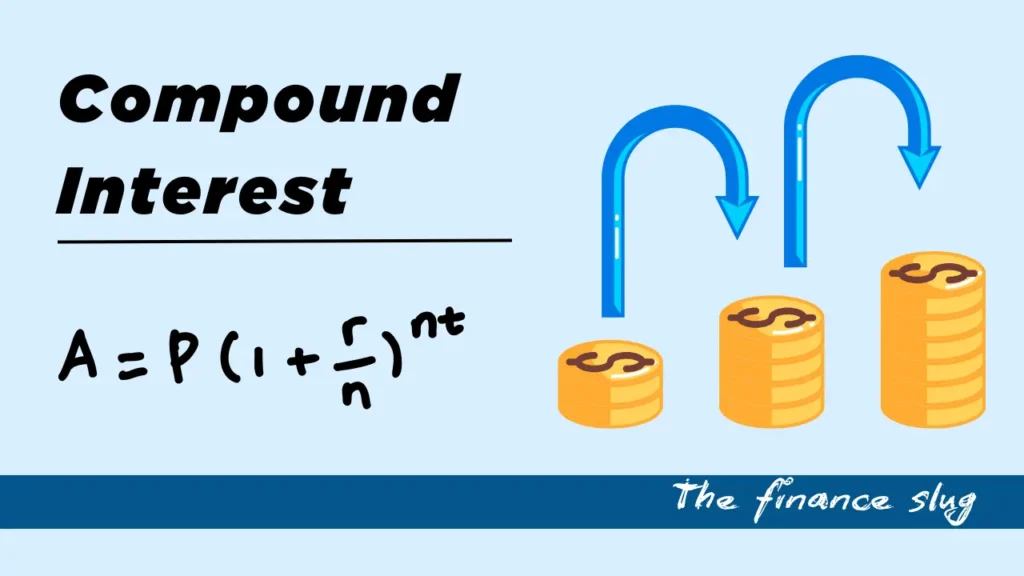

The formula for compound interest is relatively simple: A=P(1+rn)ntA = P \left( 1 + \frac{r}{n} \right)^{nt}

A = P(1 + r/n)nt

Where:

- A = the amount of money accumulated after interest

- P = the principal amount (the initial sum of money)

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per year

- t = the time the money is invested or borrowed for, in years

Example:

Let’s say you invest $1,000 at an annual interest rate of 5%, compounded annually for 3 years. Using the compound interest formula:

A = 1000(1 + 0.05/1)1 × 3 = 1000 × (1.05)3 = 1000 × 1.157625 = 1,157.63

So, after 3 years, your investment grows to $1,157.63, which is an extra $157.63 in interest.

The Rule of 72

A quick and easy way to estimate how long it will take for your investment to double is by using the Rule of 72. The Rule of 72 states that you can divide 72 by your annual interest rate (as a percentage) to estimate the number of years it will take for your investment to double.

For example, if you invest at an interest rate of 6%, you would divide 72 by 6 to get 12 years. This means it would take approximately 12 years for your investment to double.

Examples of Compound Interest in Action

To truly grasp the power of compound interest, let’s look at a few examples of how it works in real life.

Example 1: A Simple Savings Account

Imagine you deposit $100 into a savings account that offers a 5% annual interest rate, compounded monthly. After 10 years, you would have accumulated $1,628.89. While this may seem modest, remember that the interest is compounding each month, allowing your investment to grow faster.

Example 2: Investing in Stocks

If you invest in the stock market, you might expect a higher return—let’s say 8% annually. With the same $100 monthly investment, compounded monthly, after 10 years, your investment would grow to approximately $19,000. This example highlights the importance of starting early and allowing your investments to compound over time.

In both cases, the longer you let your money grow, the more powerful the effect of compound interest becomes.

Benefits of Compound Interest

1. Accelerates Your Savings Over Time

The most significant benefit of compound interest is how it accelerates the growth of your investments. As the interest you earn gets added to the principal, your money grows faster and faster the longer you leave it in the account or investment.

2. Works for Both Savings and Investments

Whether you’re building an emergency fund or investing in stocks, compound interest works in your favor. The more often your money compounds, the more interest you’ll earn over time.

3. Helps With Debt Reduction

Compound interest isn’t just beneficial for growing savings; it also works against you when you owe money. If you’re carrying credit card debt, for example, the interest compounds, increasing the amount you owe each month. However, by making extra payments or paying your debt off more quickly, you can reduce the impact of compounding interest on your debt.

4. The Earlier You Start, the Greater the Benefit

Starting early gives your money more time to compound and grow. Even if you start with a small amount, compound interest can lead to significant growth over time. For example, if you start saving at 25 instead of 35, your savings could grow substantially more by the time you retire.

Common Mistakes to Avoid

While compound interest can work wonders for your finances, there are some common mistakes to watch out for:

1. Waiting Too Long to Start Saving

The biggest mistake people make is waiting until later in life to start saving. The earlier you begin, the more time your money has to grow. Starting at age 25 is far more beneficial than starting at 35.

2. Making Only Minimum Payments on Debt

If you only make the minimum payments on your credit card debt, the interest will compound, and you’ll end up paying much more in the long run. It’s important to pay down your debt as quickly as possible to minimize the impact of compound interest.

3. Not Taking Advantage of Compound Interest in Investments

Don’t just let your savings sit in a regular savings account with low-interest rates. Instead, consider investing in stocks, bonds, or mutual funds that offer higher returns, allowing compound interest to work its magic.

Tools for Calculating Compound Interest

There are several online calculators that can help you easily calculate compound interest. Websites like Investopedia, Bankrate, and others offer free tools where you can input your principal, interest rate, and compounding frequency to see how your investment will grow over time.

Alternatively, you can use Excel to perform compound interest calculations. Simply use the formula we discussed earlier, and Excel will calculate the results for you.

Conclusion

Compound interest is a powerful tool that can significantly boost your financial growth. By understanding how it works and taking advantage of it in your savings and investments, you can build wealth over time. The key is to start early, be patient, and let your money grow. Whether you’re saving for retirement or investing in the stock market, compound interest can help you achieve your financial goals.