- Introduction: Understanding Accountability in Finance

- What is Accountability in Finance?

- The Key Principles of Financial Accountability

- Types of Financial Accountability

- The Impact of Financial Accountability on Businesses

- Best Practices for Ensuring Financial Accountability

- The Role of Technology in Financial Accountability

- Challenges in Maintaining Financial Accountability

- Conclusion: Strengthening Financial Accountability for a Better Future

- Frequently Asked Questions (FAQs)

Introduction: Understanding Accountability in Finance

Accountability is a cornerstone of financial integrity and transparency, playing a crucial role in business, personal finance, and government policies. But what does accountability truly mean in financial terms? It refers to the obligation of individuals and organizations to report, explain, and be answerable for financial decisions, ensuring responsible management of resources.

In this article, we will explore the concept of financial accountability, its importance, key principles, and best practices to maintain financial integrity. Whether you’re managing a business, handling personal finances, or working in corporate governance, understanding accountability is essential for long-term success.

What is Accountability in Finance?

Definition of Financial Accountability

Financial accountability refers to the process of managing and reporting financial transactions transparently and ethically. It involves ensuring that financial decisions are made responsibly, backed by accurate records, and aligned with organizational or personal financial goals.

Why is Financial Accountability Important?

Financial accountability ensures trust, prevents fraud, and promotes long-term financial health. Without accountability, businesses, governments, and individuals risk financial instability, mismanagement, and legal consequences.

The Key Principles of Financial Accountability

To uphold financial accountability, businesses and individuals must follow several fundamental principles:

1. Transparency

- Ensuring financial statements and records are open for review

- Providing clear financial reports to stakeholders

- Avoiding misleading financial data

2. Responsibility

- Taking ownership of financial decisions

- Ensuring ethical handling of funds

- Complying with financial laws and regulations

3. Integrity

- Upholding honesty in financial transactions

- Preventing fraud and financial misrepresentation

- Reporting discrepancies accurately

4. Compliance

- Adhering to financial policies and legal standards

- Following tax regulations and corporate governance guidelines

- Implementing financial risk management practices

Also Read : Account Statements Explained: Importance, Types, and How to Read Them

Types of Financial Accountability

Financial accountability applies in various contexts. Let’s explore some of the key areas where it plays a critical role:

1. Corporate Financial Accountability

Businesses must maintain accountability to stakeholders, including investors, employees, and regulatory authorities. This involves:

- Preparing accurate financial reports

- Complying with tax and regulatory obligations

- Avoiding financial mismanagement and fraud

2. Government Financial Accountability

Governments must ensure public funds are used responsibly. This includes:

- Transparent budgeting and spending

- Preventing corruption and misuse of public money

- Conducting financial audits for government programs

3. Personal Financial Accountability

Individuals must take responsibility for their financial well-being. Key aspects include:

- Budgeting and tracking expenses

- Paying debts on time

- Saving for future financial goals

4. Non-Profit Financial Accountability

Charities and non-profits must ensure donor funds are used ethically and effectively by:

- Providing financial transparency in reports

- Avoiding misuse of donations

- Meeting legal and ethical financial obligations

The Impact of Financial Accountability on Businesses

Building Trust with Stakeholders

Accountability fosters trust among investors, customers, and employees. Businesses that practice financial transparency attract more investors and build a strong market reputation.

Enhancing Financial Performance

Companies with robust financial accountability practices often achieve better financial stability and profitability. Proper budgeting, reporting, and compliance lead to sound financial decisions.

Preventing Financial Fraud

Accountability measures such as audits, internal controls, and compliance programs help reduce the risk of fraud and financial misconduct.

Compliance with Legal and Ethical Standards

Companies adhering to financial accountability prevent legal troubles, fines, and reputational damage.

Best Practices for Ensuring Financial Accountability

Businesses and individuals can enhance financial accountability by implementing the following best practices:

1. Maintain Accurate Financial Records

- Keep detailed records of all financial transactions

- Use accounting software for better accuracy

- Regularly reconcile accounts to detect discrepancies

2. Conduct Regular Audits

- Perform internal and external audits periodically

- Identify financial risks and address them proactively

- Ensure compliance with financial regulations

3. Implement Strong Financial Controls

- Segregate financial duties among employees

- Establish checks and balances in financial transactions

- Use secure financial management systems

4. Promote Ethical Financial Practices

- Train employees on financial ethics and accountability

- Encourage whistleblowing for financial misconduct

- Avoid conflicts of interest in financial decisions

5. Engage Stakeholders in Financial Decisions

- Communicate financial strategies transparently

- Involve investors and board members in decision-making

- Publish financial reports for public review

Also Read : Dave Portnoy Fires Back at Crypto Manipulation Allegations

The Role of Technology in Financial Accountability

Modern technology plays a vital role in improving financial accountability. Here’s how:

1. Accounting Software and Automation

- Reduces errors in financial transactions

- Ensures real-time tracking of financial data

- Enhances compliance with tax and audit requirements

2. Blockchain for Financial Transparency

- Provides a decentralized and tamper-proof financial record

- Ensures trust in financial transactions

- Reduces financial fraud in businesses and governments

3. AI and Data Analytics

- Identifies financial risks through predictive analytics

- Detects anomalies and fraud patterns in real-time

- Improves financial decision-making through data-driven insights

Challenges in Maintaining Financial Accountability

Also Read : What is an Account Number? Definition, Importance, and Security Tips

Despite its importance, financial accountability comes with several challenges:

1. Lack of Proper Financial Education

Many individuals and businesses struggle with financial accountability due to poor financial literacy.

2. Fraud and Corruption Risks

Businesses and governments often face risks of embezzlement, fraud, and financial misconduct.

3. Complexity of Financial Regulations

Understanding and complying with evolving financial laws can be challenging.

4. Resistance to Transparency

Some organizations and individuals hesitate to disclose financial details, affecting accountability efforts.

Conclusion: Strengthening Financial Accountability for a Better Future

Financial accountability is essential for ensuring financial integrity, preventing fraud, and fostering trust in businesses, governments, and personal finance. By following best practices, leveraging technology, and promoting transparency, individuals and organizations can uphold strong financial accountability.

Whether you’re managing personal finances, running a business, or working in public administration, accountability should always be a priority. Implementing ethical financial practices and ensuring compliance with regulations will not only protect financial interests but also promote sustainable financial growth.

Frequently Asked Questions (FAQs)

1. Why is financial accountability important in business?

Financial accountability ensures transparency, trust, and financial stability, preventing fraud and legal issues.

2. How can businesses improve financial accountability?

Businesses can enhance accountability through accurate financial reporting, audits, strong internal controls, and ethical financial practices.

3. What are the consequences of poor financial accountability?

Lack of accountability can lead to financial mismanagement, fraud, legal penalties, and reputational damage.

4. How does technology help in financial accountability?

Technologies like accounting software, blockchain, and AI improve financial tracking, transparency, and fraud detection.

5. What is the role of financial audits in accountability?

Financial audits verify the accuracy of financial records, ensuring compliance with regulations and identifying financial risks.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

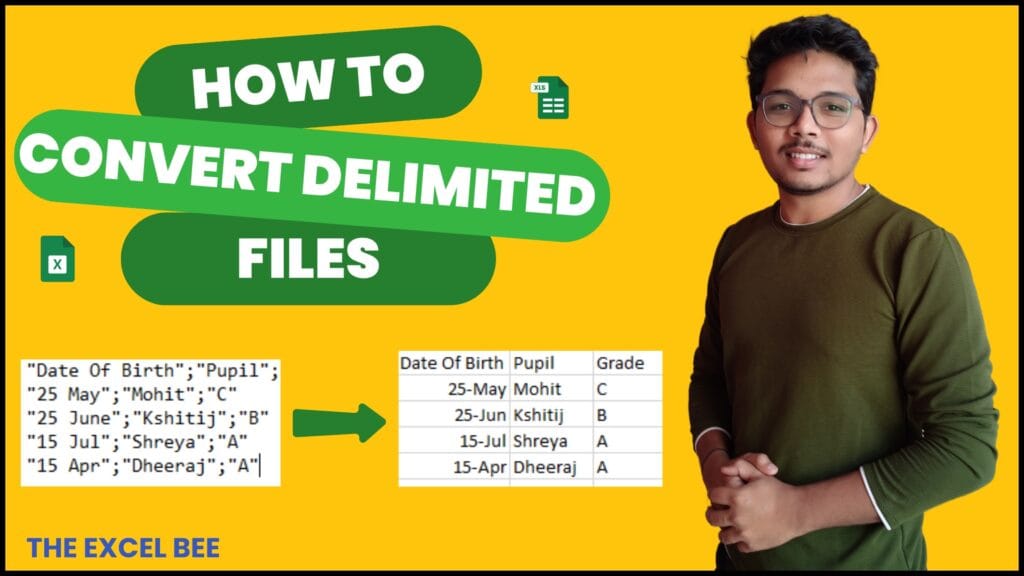

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…