Introduction

Accounting is often referred to as the “language of business.” It is a systematic process of recording, summarizing, analyzing, and reporting financial transactions. Whether you are an entrepreneur, a student, or an investor, understanding accounting is essential for making informed financial decisions.

In this article, we will dive deep into the concept of accounting, its types, principles, and why it plays a crucial role in financial management.

What is Accounting?

Accounting is the process of recording, classifying, summarizing, and interpreting financial information to provide meaningful insights into a business’s financial health. It ensures that financial data is accurate, reliable, and accessible for decision-making.

Accounting serves multiple purposes, such as:

- Tracking income and expenses

- Managing business finances

- Ensuring tax compliance

- Providing financial reports to stakeholders

It plays a vital role in businesses, organizations, and even personal finance management.

Also Read : Accountant Responsibility: Roles, Duties, and Ethical Standards

Types of Accounting

Accounting is categorized into several types based on its functions and applications. Below are the major types of accounting:

1. Financial Accounting

Financial accounting involves the preparation of financial statements such as balance sheets, income statements, and cash flow statements. It focuses on historical financial data to present a company’s financial position to external stakeholders, including investors, creditors, and regulators.

2. Managerial Accounting

Managerial accounting helps business leaders make data-driven decisions by analyzing financial data. It includes budgeting, cost analysis, and performance evaluation to improve efficiency and profitability.

3. Cost Accounting

Cost accounting involves calculating and analyzing the costs associated with producing goods or services. It helps businesses control expenses and optimize pricing strategies.

4. Tax Accounting

Tax accounting ensures compliance with tax laws and regulations. It involves preparing tax returns, calculating tax liabilities, and implementing tax-saving strategies.

5. Auditing

Auditing is the process of reviewing financial statements to ensure their accuracy and compliance with accounting standards. It can be internal (conducted within the organization) or external (performed by independent auditors).

6. Forensic Accounting

Forensic accounting is used in legal matters such as fraud investigations and financial disputes. It involves analyzing financial records to detect irregularities and fraudulent activities.

7. Government Accounting

Government accounting manages public funds and ensures transparency in financial operations of government agencies. It follows specific regulations set by authorities.

Key Principles of Accounting

Accounting follows fundamental principles to ensure consistency, accuracy, and reliability in financial reporting. Here are the key principles:

1. Accrual Principle

Revenues and expenses are recorded when they occur, regardless of when cash transactions happen.

2. Consistency Principle

Companies must use the same accounting methods over time to ensure comparability.

3. Going Concern Principle

Financial statements assume that the business will continue operating indefinitely.

4. Matching Principle

Expenses should be recorded in the same period as the revenues they help generate.

5. Conservatism Principle

Accountants should report potential losses but not anticipate gains.

6. Materiality Principle

Only significant financial data that affects decision-making should be recorded.

7. Objectivity Principle

Financial data should be based on verifiable evidence and free from bias.

Importance of Accounting in Business

Accounting is crucial for businesses of all sizes. Here’s why:

1. Helps in Decision-Making

Accurate financial data allows business owners and managers to make informed decisions about investments, expenses, and growth strategies.

2. Ensures Legal Compliance

Accounting helps businesses comply with tax laws, financial regulations, and reporting requirements.

3. Provides Financial Transparency

Stakeholders, including investors, creditors, and employees, rely on financial statements to assess a company’s performance.

4. Facilitates Budgeting and Planning

Accounting helps businesses create budgets, control expenses, and plan for future financial needs.

5. Aids in Tax Preparation

Proper accounting ensures timely and accurate tax filing, reducing the risk of penalties.

6. Detects Fraud and Errors

Accounting systems help identify financial irregularities and prevent fraud.

The Accounting Process: Step-by-Step

The accounting cycle consists of several steps:

- Identifying Transactions – Recording business transactions based on source documents.

- Journalizing Transactions – Entering financial transactions into the accounting journal.

- Posting to Ledger Accounts – Transferring journal entries to individual accounts in the ledger.

- Preparing a Trial Balance – Checking whether debits and credits are balanced.

- Adjusting Entries – Making necessary adjustments for accrued and prepaid items.

- Preparing Financial Statements – Creating financial reports based on recorded data.

- Closing Entries – Closing temporary accounts to prepare for the next accounting period.

Modern Accounting Trends

With advancements in technology, accounting is evolving rapidly. Some key trends include:

- Cloud Accounting: Businesses use cloud-based platforms like QuickBooks and Xero for real-time financial tracking.

- Automation: AI-powered accounting software reduces manual work and improves accuracy.

- Blockchain in Accounting: Blockchain enhances transparency and security in financial transactions.

- Data Analytics: Companies use big data analytics to gain deeper financial insights.

Conclusion

Accounting is an indispensable part of any business or organization. It provides a clear financial picture, ensures compliance, and helps in strategic decision-making. Whether you are an entrepreneur, an investor, or a student, understanding accounting fundamentals will empower you to navigate the financial world confidently.

By implementing sound accounting practices, businesses can achieve financial stability, improve profitability, and ensure long-term success.

Also Read : What is an Accountant? Role, Responsibilities, and Career Guide

Frequently Asked Questions (FAQs)

1. What is the main purpose of accounting?

The main purpose of accounting is to record, summarize, and report financial transactions to provide accurate financial information for decision-making.

2. What are the basic types of accounting?

The major types include financial accounting, managerial accounting, cost accounting, tax accounting, auditing, forensic accounting, and government accounting.

3. Why is accounting important for businesses?

Accounting helps businesses track financial performance, ensure compliance, make informed decisions, and manage taxes efficiently.

4. What are the fundamental principles of accounting?

Key principles include the accrual principle, consistency principle, matching principle, and objectivity principle, among others.

5. How has technology changed accounting?

Modern accounting relies on automation, cloud computing, blockchain, and data analytics to improve accuracy, efficiency, and transparency.

Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian…

Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

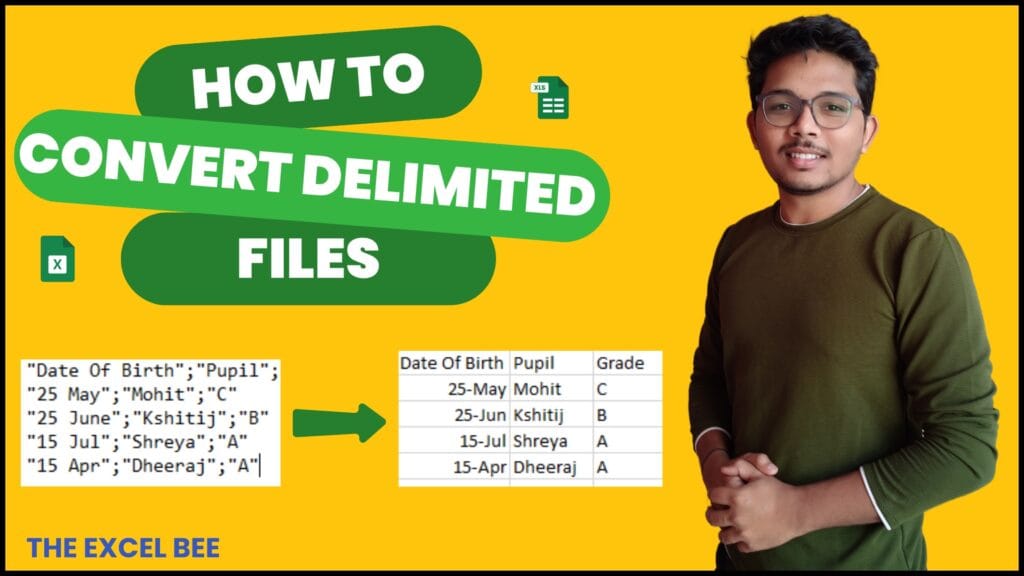

How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel,…

Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking…

Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge…

Forever 21 Files for Bankruptcy Again: The End of an Era in Fast Fashion?

Forever 21, once a staple in American malls and a leader in the fast-fashion industry,…