Managing your money effectively starts with understanding where it’s coming from and where it’s going. A cash flow statement for personal finance is one of the best tools to help you take control of your financial life. By tracking your income and expenses, you can make smarter decisions and work towards your financial goals.

In this guide, we’ll explain what a cash flow statement is, why it’s essential, how to create one, and how it can transform your personal finances. Plus, we’ve included a free template and a YouTube tutorial to help you get started right away.

What is a Cash Flow Statement?

A cash flow statement is a simple yet powerful tool that tracks the money flowing in and out of your accounts during a specific period. While businesses use this tool to measure financial health, individuals can apply it to gain a clear understanding of their personal finances.

Key Components of a Cash Flow Statement

- Income:

This refers to all the money you receive. Common income sources include:- Salary or wages: Your primary source of income from employment.

- Side hustles or freelance earnings: Additional money earned from part-time gigs or freelance work.

- Rental income: earnings from renting out property or assets.

- Investment returns: dividends, interest, or profits from investments.

- Expenses:

These are all your outgoing payments, which can be categorized as:- Fixed costs: expenses that remain constant, such as rent, insurance premiums, and loan payments.

- Variable costs: spending that fluctuates monthly, like groceries, dining out, entertainment, and transportation.

- Net cash flow:

This is the result of subtracting your total expenses from your total income. A positive cash flow indicates healthy finances, while a negative cash flow suggests the need for adjustments.

Why is a cash flow statement essential for personal finance?

Tracking your cash flow isn’t just about being organized—it’s about gaining control over your financial life. A cash flow statement offers several benefits:

1. Tracks Your Financial Health

By regularly updating your cash flow statement, you can monitor your financial condition and ensure you’re living within your means. If you notice recurring negative cash flows, you can take timely corrective actions.

2. Identifies Spending Habits

A breakdown of expenses helps you pinpoint areas where you might overspend. Whether it’s unnecessary subscriptions or frequent dining out, small changes in these habits can lead to significant savings over time.

3. Helps Achieve Financial Goals

Whether you’re saving for a big purchase, paying off debt, or building an emergency fund, a cash flow statement ensures your money is directed toward your priorities.

4. Reduces Financial Stress

When you know exactly where your money is going and how much you have left, you feel more confident about managing unexpected expenses or planning for the future.

How to Create a Cash Flow Statement for Personal Finance

Creating a cash flow statement might sound complicated, but it’s quite straightforward. With the right tools, you’ll have a clear overview of your finances in no time.

Step 1: Download the Template

To save time and simplify the process, use my Cash Flow Statement Template. It’s pre-designed to help you track income and expenses and calculate your net cash flow.

Download the Cash Flow Statement Template Here

Step 2: List All Sources of Income

Start by documenting every income source. Be thorough and include all potential streams:

- Salary or wages: Your monthly paycheck or earnings from your job.

- Side hustles or freelance work: Additional earnings from part-time gigs, projects, or online platforms.

- Rental income: money earned from leasing out property, such as a spare room or apartment.

- Investment returns: dividends, interest, or gains from stocks, bonds, or mutual funds.

Step 3: Record All Expenses

Categorize your expenses into fixed and variable costs to get a clearer picture:

- Fixed costs: These include rent, mortgage payments, loan installments, and utility bills. Since these amounts remain constant, they’re easier to track.

- Variable costs: groceries, dining out, subscriptions, entertainment, and transportation fall under this category. Tracking these helps you identify areas where you can cut back.

Step 4: Calculate Your Net Cash Flow

Subtract your total expenses from your total income. The result will show your net cash flow:

- Positive cash flow: You’re earning more than you’re spending, which is a good sign.

- Negative cash flow: You’re spending more than you’re earning, which requires immediate adjustments.

Step 5: Analyze the Results

Review your cash flow patterns. Are there months when your expenses spike? Are you overspending on non-essentials? Use these insights to adjust your habits and plan better for the future.

Watch: Step-by-Step Guide of Cash Flow Statement for Personal Finance

To help you get started, I’ve attached this YouTube video that walks you through the process of creating and using a cash flow statement.

In this video, you’ll learn how to categorize income and expenses, calculate net cash flow, and use the results to make smarter financial decisions.

Practical Applications of a Cash Flow Statement for Personal Finance

Once you’ve created your cash flow statement, you can use it to:

1. Create a Budget

A cash flow statement gives you a clear view of how much money you have available for different expense categories. This ensures your budget is realistic and aligns with your financial priorities.

2. Manage Debt/credit

With a cash flow statement, you can identify surplus funds and allocate them toward paying off debts/credit faster. This helps reduce interest costs and shortens the repayment timeline.

3. Build Savings and Investments

If you have a positive cash flow, you can direct the surplus toward savings or investments. This could include building an emergency fund, contributing to a retirement account, or exploring growth-oriented investment options.

Common Mistakes to Avoid

Even the best tools can’t save you from mistakes if you’re not careful. Avoid these common pitfalls:

1. Ignoring Irregular Expenses

Many people forget to account for one-off or seasonal expenses, such as holiday shopping, annual insurance premiums, or birthday gifts. Plan ahead by including these costs in your cash flow statement.

2. Overlooking Small Transactions

Small, frequent purchases like daily coffee runs or app subscriptions may seem insignificant but can add up over time. Tracking these ensures you’re not underestimating your expenses.

3. Failing to Update Regularly

A cash flow statement is only useful if it reflects your current financial situation. Make it a habit to update your statement weekly or monthly for the most accurate results.

Long-Term Benefits of Maintaining a Cash Flow Statement

The benefits of maintaining a cash flow statement go beyond short-term planning. Here’s how it helps in the long run:

1. Improved Financial Stability

Regularly tracking your cash flow ensures you live within your means and build a strong financial foundation.

2. Informed Decision-Making

Whether you’re deciding on a big purchase, planning for retirement, or considering a new investment, a cash flow statement provides the clarity needed to make confident choices.

3. Peace of Mind

Knowing your financial situation inside-out reduces stress and allows you to focus on achieving your long-term goals.

Conclusion: Take Charge of Your Finances

A cash flow statement for personal finance is more than just a tracking tool—it’s your roadmap to financial freedom. By understanding your income, expenses, and spending habits, you gain the clarity needed to make meaningful changes in your financial life.

With the free template and YouTube tutorial provided in Cash Flow Statement for Personal Finance, you have everything you need to get started. Take the first step today and watch your finances transform over time.

FAQs: Cash Flow Statement for Personal Finance

Article Resources

- Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian equity benchmark indices BSE Sensex and Nifty50 took a brutal… Read more: Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

Published on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian equity benchmark indices BSE Sensex and Nifty50 took a brutal… Read more: Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know - Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous Year

Wall Street’s bonus pool hit a record $47.5B in 2024, up 34% from 2023, marking the highest payout since 1987.

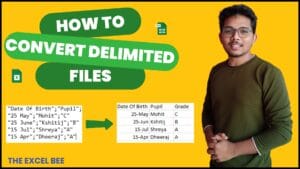

Wall Street’s bonus pool hit a record $47.5B in 2024, up 34% from 2023, marking the highest payout since 1987. - How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel, the data often appears in a single column instead of… Read more: How to Convert Delimited CSV Data into Columns in Excel

CSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel, the data often appears in a single column instead of… Read more: How to Convert Delimited CSV Data into Columns in Excel - Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking initiative to make higher education more accessible. Starting from the… Read more: Harvard University Announces Free Tuition for Families Earning $200K or Less

Harvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking initiative to make higher education more accessible. Starting from the… Read more: Harvard University Announces Free Tuition for Families Earning $200K or Less - Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge in pharmaceutical investments, thanks to the skyrocketing demand for weight-loss… Read more: Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs

Ireland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge in pharmaceutical investments, thanks to the skyrocketing demand for weight-loss… Read more: Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs