For many people, tax season brings about a mix of emotions—stress, anxiety, and sometimes relief. With the 2025 tax season fast approaching, understanding the Tax Extension Deadline 2025 is crucial. This guide explains what tax extensions are, how they work, and why they might be the right choice for you. Whether you’re filing as an individual or a business owner, knowing the rules, deadlines, and best practices can save you from costly mistakes and unnecessary stress.

What Is a Tax Extension?

A tax extension allows taxpayers extra time to file their income tax returns. It’s important to clarify that an extension only applies to filing the return, not to paying any taxes you owe. By law, taxes owed must still be paid by the original filing deadline, typically April 15, to avoid penalties and interest charges.

The Tax Extension Deadline 2025 gives individuals and businesses an additional six months to submit their tax returns, extending the filing date to October 15, 2025. This grace period can be invaluable for taxpayers who need more time to gather documentation, resolve financial issues, or consult with a tax professional.

Key Dates and Deadlines for the 2025 Tax Season

The tax calendar is the foundation for proper planning. Mark these important dates for 2025:

- April 15, 2025:

This is the standard tax deadline for filing your federal income tax return for the 2024 tax year. If you need more time to file, this is also the deadline to submit Form 4868, which is the formal application for a filing extension. - October 15, 2025:

For those granted an extension, October 15 is the final date to file your completed tax return. Missing this deadline can result in significant penalties, so it’s crucial to plan accordingly.

Understanding these dates ensures you won’t face unnecessary penalties or interest due to missed deadlines.

Why Would You Need a Tax Extension?

Life can be unpredictable, and there are several legitimate reasons why taxpayers might need an extension. Some common scenarios include:

- Incomplete Documentation: Missing W-2s, 1099s, or other required forms can delay the filing process.

- Complex Financial Situations: If you’ve experienced major life changes—such as buying a home, starting a business, or inheriting assets—you may need more time to ensure your return is accurate.

- Professional Assistance: If you’re working with a tax preparer who is overwhelmed with clients, filing for an extension can give you additional time to ensure your return is properly reviewed.

- Unexpected Circumstances: Illness, natural disasters, or other unforeseen events can make it difficult to meet the filing deadline.

A tax extension provides much-needed breathing room to navigate these challenges without the added pressure of looming deadlines.

How to File for a Tax Extension in 2025

Filing for a tax extension is a straightforward process, but it requires attention to detail. Here are the steps to follow:

1. Complete Form 4868

The IRS requires taxpayers to submit Form 4868, officially known as the “Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.” This form can be completed electronically or mailed to the IRS.

2. Pay Estimated Taxes

Even with an extension, any taxes owed must be paid by April 15, 2025. Use prior-year returns and current income information to estimate your tax liability. Paying on time helps you avoid late payment penalties and interest.

3. Submit Your Request

You can file Form 4868 through several methods:

- Electronically: Use the IRS e-file system or authorized tax software for a quick and easy submission.

- Mail: Download Form 4868 from the IRS website, fill it out, and mail it to the appropriate address listed in the instructions. Be sure it’s postmarked by April 15.

- Payment as an Extension: If you make an electronic payment via the IRS system and indicate it’s for an extension, Form 4868 is automatically filed for you.

What Happens After You File for an Extension?

Once your extension request is approved, you have until October 15, 2025, to file your tax return. Keep in mind that while the extension gives you more time to file, it does not absolve you from paying any taxes owed by the original April deadline.

The IRS typically doesn’t send a confirmation for mailed extension requests, so if you choose this method, consider using certified mail to ensure it was received. For electronic submissions, you should receive an acknowledgment within 48 hours.

Consequences of Missing the Tax Extension Deadline

Missing the Tax Extension Deadline 2025 can result in steep penalties. The failure-to-file penalty is usually 5% of the unpaid taxes for each month the return is late, up to a maximum of 25%. Additionally, interest will accrue on unpaid taxes starting from April 15, regardless of whether an extension was granted.

If you think you’ll miss the extended deadline, contact the IRS as soon as possible. In some cases, you may qualify for penalty relief if you can demonstrate reasonable cause.

State Tax Extensions

It’s important to remember that state tax deadlines may differ from federal deadlines. While some states automatically grant extensions if you file a federal extension, others require a separate request. Check with your state’s tax agency to confirm requirements and deadlines.

Common Misunderstandings About Tax Extensions

Many taxpayers hesitate to file for an extension due to misconceptions. Let’s clear up some of the most common myths:

- Extensions Mean You’ll Be Audited: Filing an extension does not increase your chances of being audited. The IRS is primarily concerned with accuracy and compliance, not the timing of your submission.

- You Don’t Need to Pay Taxes Until October: This is false. Taxes owed must be paid by April 15, regardless of whether you file an extension.

- Extensions Are Only for Individuals: Businesses can also file for extensions using Form 7004.

- Also look after the

Understanding these points can help you make an informed decision about whether to file for an extension.

Tips for Managing Your Taxes

Planning ahead can make tax season much smoother. Here are a few tips to help you stay organized and avoid last-minute stress:

- Start preparing your return early, even if you anticipate filing an extension.

- Keep track of all income and expense documents throughout the year to avoid scrambling for paperwork in April.

- Use reputable tax software or consult a professional to ensure your return is accurate.

- Regularly check the IRS website for updates and resources.

Why Understanding the Tax Extension Deadline 2025 Matters

Filing taxes can be overwhelming, but understanding the rules and deadlines can make the process more manageable. The Tax Extension Deadline 2025 offers taxpayers valuable flexibility, allowing them to file accurate and complete returns without rushing. However, it’s important to remember that while extensions provide more time to file, they don’t change the payment deadline.

By staying informed, planning ahead, and seeking professional advice when needed, you can navigate the tax season confidently and avoid unnecessary penalties.

Conclusion

The Tax Extension Deadline 2025 is an essential safety net for taxpayers who need more time to file their returns. Whether you’re dealing with complex finances, missing documents, or unexpected events, an extension can provide much-needed relief. Just remember to pay any taxes owed by April 15 to avoid late-payment penalties.

As we approach Tax Season 2025, it’s important to understand how the Child Tax Credit works and how you can claim it to maximize your refund this year.

For more information and step-by-step guidance, visit the IRS official website. By staying proactive and organized, you can make tax season a stress-free experience.

FAQ

- Stock Market Crash Today: A Bloodbath on Monday – What You Need to KnowPublished on financeslug.xyz The global financial markets are reeling from a massive sell-off, and Indian equity benchmark indices BSE Sensex and Nifty50 took a brutal… Read more: Stock Market Crash Today: A Bloodbath on Monday – What You Need to Know

- Wall Street Bonuses Reach Record $47.5 Billion in 2024, Up 34% from Previous YearWall Street’s bonus pool hit a record $47.5B in 2024, up 34% from 2023, marking the highest payout since 1987.

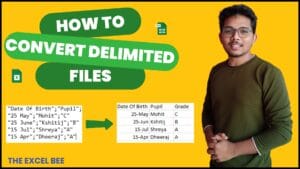

- How to Convert Delimited CSV Data into Columns in ExcelCSV (Comma-Separated Values) files are widely used for data exchange, but when opened in Excel, the data often appears in a single column instead of… Read more: How to Convert Delimited CSV Data into Columns in Excel

- Harvard University Announces Free Tuition for Families Earning $200K or LessHarvard’s New Tuition-Free Policy: What You Need to Know Harvard University has unveiled a groundbreaking initiative to make higher education more accessible. Starting from the… Read more: Harvard University Announces Free Tuition for Families Earning $200K or Less

- Eli Lilly’s 1.8B Dollar Investment in Weight Loss DrugsIreland’s Weight-Loss Drug Boom: A Game-Changer for Economy and Healthcare Ireland is witnessing a surge in pharmaceutical investments, thanks to the skyrocketing demand for weight-loss… Read more: Eli Lilly’s 1.8B Dollar Investment in Weight Loss Drugs